The National Personal Finance Challenge (NPFC) is a nationwide competition that offers high school students the opportunity to build and demonstrate their knowledge in the concepts of earning income, spending, saving, investing, managing credit, and managing risk.

In the first round of the NPFC, student teams compete in a fun online 30-question challenge. High-scoring student teams are invited to their state finals. State champions proceed to the National competition, where teams use their knowledge to create a financial plan for a fictitious family scenario. The top 16 teams in the National Finals will advance to compete for the national championship title in a Quiz Bowl.

At the National Finals, ALL EXPENSES are covered including food, hotel, and events (transportation to/from state of origin excluded). The top four teams win cash prizes at our exciting in-person National Finals.

With over 15,000 students participating annually, our vision is to expand to 50,000 annual participants by 2025 from all over the country. We continue our efforts to make the program accessible to a diverse set of participants; trying to reach students from all corners of the nation. Currently, over 40% of our participants are from diverse backgrounds, reflecting our commitment to inclusivity and diversity.

All finalist team members receive cash prizes:

1st place $2,000 | 2nd place $1,000 | 3rd place $500 | 4th place $250

Investing in Student Teams and Their Futures

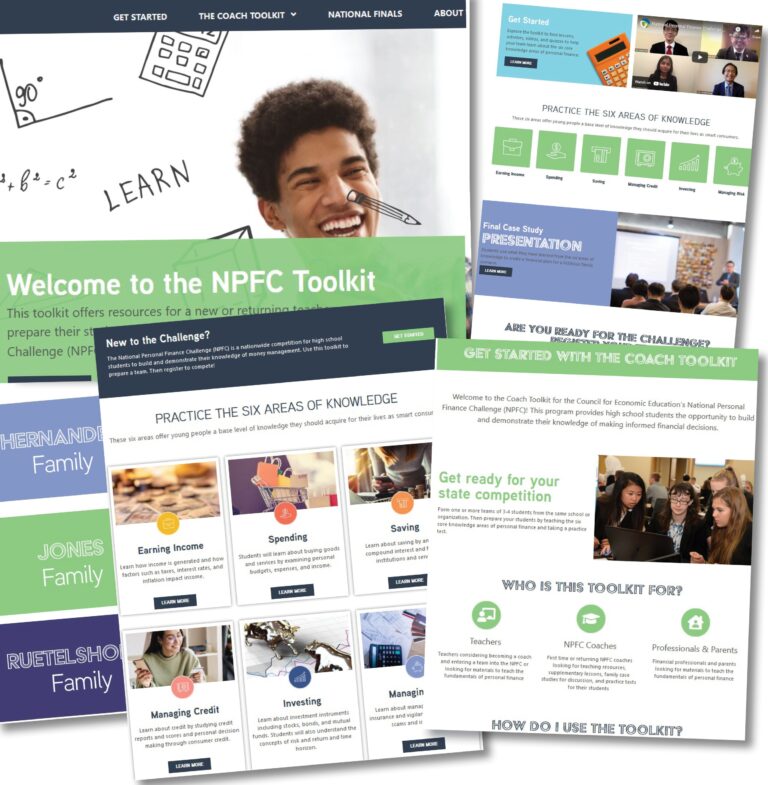

The Council for Economic Education offers free resources for teachers and NPFC team coaches to ensure that the kids in their communities develop a solid understanding of the six core knowledge areas of personal finance. The online NPFC Toolkit includes engaging lessons, activities, instructive videos, quizzes and family scenario case studies to ensure that students are equipped not only to compete in the NPFC—but also to take control of their financial futures.

Students will learn about:

Earning Income

How it’s generated and how factors such as taxes, interest rates, and inflation impact income.

Spending

Buying goods and services by examining personal budgets, expenses, and income.

Saving

Analyzing compound interest and financial institutions and services.

Managing Credit

Credit reports, credit scores, and decision-making through consumer credit.

Investing

Various investment instruments, including stocks, bonds, and mutual funds. Students will also understand the concepts of risk and return and time horizon.

Managing Risk

Different types of insurance and vigilance against common scams and identity theft.

Learn More

The competition to make you financially savvy

Financial Literacy Leads to Financial Opportunity

Many kids in high school are already earning and spending, and some may be thinking about saving and growing their personal wealth. Working with students in their teen years is vital for building financial competency and fluency while they begin to apply what they learn in the real world.

More than developing generations of educated consumers, CEE is dedicated to preparing teens to make educated decisions that impact their lives.

#Financechallenge

This program is generously funded by

This program is co-hosted by